Employer payroll tax calculator georgia

The calculator includes options for estimating Federal Social Security and Medicare Tax. The maximum an employee will pay in 2022 is 911400.

Payroll Tax What It Is How To Calculate It Bench Accounting

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. This includes tax withheld from. Withholding Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

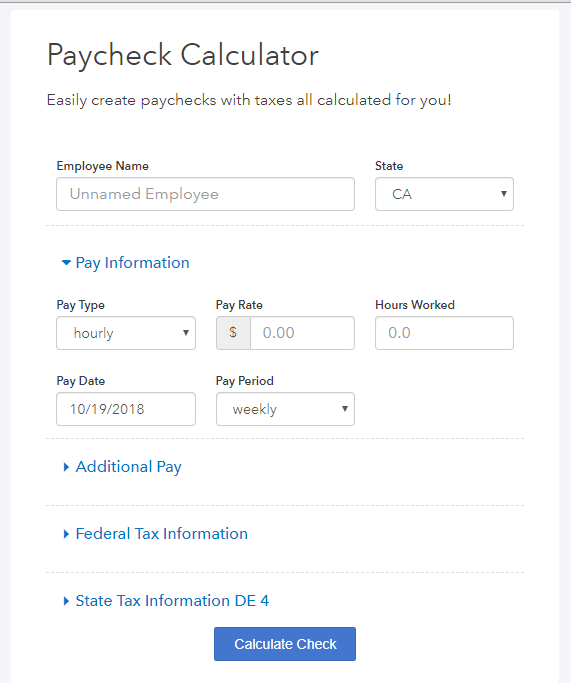

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. After a few seconds you will be provided with a full breakdown. Payroll Tax Salary Paycheck Calculator Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck. However you can also claim a tax credit of up to 54 a max of 378. Federal taxes can range anywhere from 0 to 37 of taxable earnings so deduct Federal taxes.

Georgia Paycheck CalculatorPhoto credit. Georgia payroll calculators Latest insights The Peach State has a progressive income tax system with income tax rates similar to the national average. The state of Georgias.

Use the Georgia paycheck. While Georgia has one of the lowest. Georgia requires employersexcept those in the farming sawmill and turpentine industriesto pay all employees all wages due on paydays selected by the employer.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. The next step in determining payroll taxes in Georgia is to calculate Federal income tax. Latest payroll taxes rates and related laws for the state of Georgia.

The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Georgia payroll tax calculator and info for business owners and payrollHR managers. ComMarjeGeorgia Paycheck Quick FactsGeorgia income tax rate.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. In Georgia taxpayers can claim a standard deduction of 4600 for single filers and 6000 for joint filers.

All you have to do is enter wage. 8 Other taxes income tax and employee deductions How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

A Beginner S Guide To Protecting Your Business No Matter Where It Operates From Home Office Expenses Being A Landlord Small Business Tax Deductions

Canadian Personal Tax Tables Kpmg Canada

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes

2022 Federal State Payroll Tax Rates For Employers

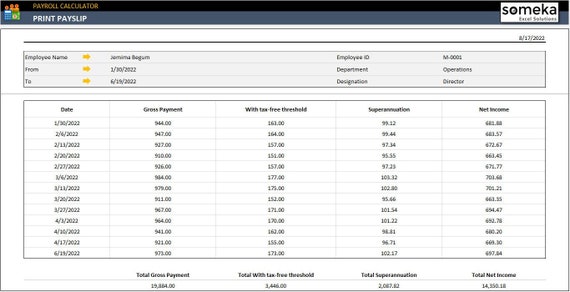

Payroll Calculator Excel Template To Calculate Taxes And Etsy Canada

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Employer Payroll Tax Calculator How To Calculate Withholding Tax

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Payroll Tax Calculator For Employers Gusto

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

2022 Federal State Payroll Tax Rates For Employers

State Payroll Taxes Guide For 2020 Article